Four steps to build loyalty within the insurance market

There was a time, a long time ago perhaps, when your relationship with your insurance provider was long and trustworthy. Each year there would be a nominal increase, usually in line with inflation, and you would instinctively renew after a friendly phone call from your broker, or a letter apparently signed by the chairman. But how times have changed.

In fact, according to financial services research specialist Consumer Intelligence, 84% of consumers shopped around for their insurance at the renewal stage last year. That’s a far cry from the apathetic loyalty of twenty years ago, so what happened?

The advent of Price Comparison websites is partly to blame and although the length of customer tenure and renewal rates does vary significantly across the industry by segment, it’s often easier to get 20 new quotes than one renewal.

So, what should UK insurance companies be doing about it?

It’s a crucial time for the general insurance sector. There’s a seismic shift in the industry landscape following the Financial Conduct Authority’s (FCA) new price regulation policy. On top of that, heavily discounted prices offered to new customers and the practice of increasing prices at renewal to existing customers, known as ‘price-walking’ has become increasingly prevalent. Not surprisingly, this has resulted in many savvy consumers shopping around to find a better deal, thus avoiding an increase in their insurance costs.

Perhaps most noticeably, however, customers are starting to look beyond pricing and consider the value an insurer can provide. As a result, many insurance brands have adopted loyalty rewards in a battle to retain existing customers. This price/value balancing act gives insurance brands the opportunity to redefine what it is they stand for, the value they can offer a consumer throughout their lifecycle, and the power of their own comms in the build-up to renewals.

Insurance brands should use their own CRM to create a unique customer journey and personalise this throughout the year, not just at renewal stage. This has to go beyond a newsletter, an email reminder or reward points. In our experience of delivering CRM, as well as designing and building the eco-systems for many financial service brands, here are our four initial steps to benefit from improved customer loyalty:

1. Standardise Your UX

There’s a key user experience principle called Jakob’s Law which states that users spend most of their time on other sites. In essence, this means they prefer your site to work in a similar way to the sites they already know. Familiarity is reassuring and so it’s crucial that websites and portals adopt this. Importantly,or those brands with multiple insurance services, your site’s UX should also be consistent throughout your real estate.

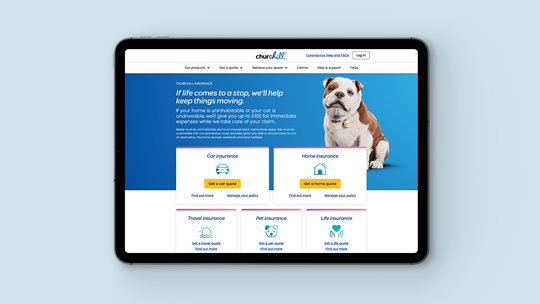

A good example of this is with Churchill. Consistency with its font, iconography, spacing, colour palettes and tone of voice as you move from car insurance to home insurance, travel insurance, pet insurance etc; all under the watchful gaze of their iconic Bulldog, the new one that is.

2. Mind Your Language

It is difficult to strike the balance between ensuring the regulatory requirements are being met and striking a chord with your audience by talking their language. Typically for large insurance companies, the design process is usually one ‘by committee’ and so there can often be too many cooks in the kitchen. This can sometimes water down the original recipe and tone of voice can suffer.

A way in which brands can maintain consistency throughout their content – while simplifying and speeding up the approval process – is by producing a tone-of-voice policy that also incorporates key brand compliance guardrails.

The tone-of-voice policy should encourage content creators to understand how customers would expect to be spoken to in real life and avoid any technical jargon; a great example of this is Monzo’s:

By empowering content owners, a brand’s language should become more digestible and consistent across all channels including media. Customers know what to expect from a brand with each interaction, helping to increase trust long term.

3. Reward Loyalty

Rewards are an effective way for insurers to do two things: 1. To encourage risk-mitigating behaviour. And 2. To develop a deeper connection and sense of loyalty in their customers. This effectively means incentivising things like safe driving, healthy living and not taking unnecessary chances in life. A good example of this is with Vitality Insurance through their Healthy Living Discounts and Good Driving Programme.

It rewards customers for improving their health and their driving, by educating and providing them with a baseline and tips on how to improve on both. In doing so, Vitality is actively reducing the risk attached to each engaged customer’s insurance policy – all the while providing benefit and value to the customer, aiding to retain customers long term.

Other insurers can and should be taking a leaf from the business model that Vitality has built. It has in essence found the ‘sweet spot’ in the insurance data value exchange. By simultaneously giving the consumer an engaging reason and purpose to maintain a relationship with the brand and share data that will help Vitality personalise its experience and price.

There are small steps that insurers can take by engaging procurement and legal teams to establish grassroots partnerships with adjacent service providers like gyms, gift retailers or connected device providers. This would enable them to speed up the delivery of a value proposition and ensure easy redemption. And that brings us on to our last tip.

4. Make It Easy

The harder it is for users to input their customer data in a quest to renew, the more likely it will be for them to shop around. Sites that pre-populate data, offer quick-compete solutions or provide speedy assistance, even virtually, when managing the process of renewing or cross-selling will ultimately enjoy healthy rates of retention and advocacy. By creating a customer centric user journey that limits the number of manual customer interactions, new customers are more likely to join while loyal customers are more likely to renew.

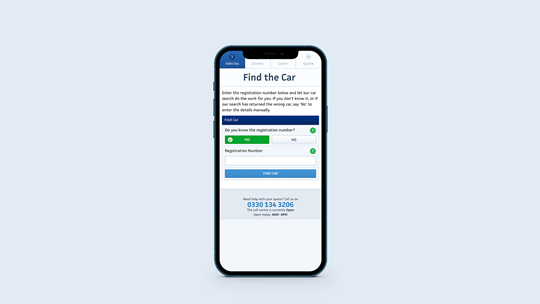

It sounds simple but for many insurance businesses this is rarely straightforward. An example of this is with Admiral Car Insurance.

They have a relatively slick service for insuring and renewing car insurance and offer good value for money for families. If, however, you need a second car insuring, their lack of multi-car policy means you can’t speak to your existing policy representative, and you must effectively start afresh. Frustrating when you find yourself duplicating driver information, address etc and it’s genuinely quicker to go to a comparison site.

These are just some ways insurers demonstrate a positive change in keeping customers for longer. A new way of delivering flexible pricing, driven by access to real-time risk data, must evolve over the next 5 years. Inevitably, it will be those insurers, who have combined legacy with a holistic focus on customer experience, that will succeed in growing market share and reducing acquisition costs.

Where would you like to go?

We’d love to understand more about your business needs and challenges. Talk to a team of exciting minds and create a collaborative partnership focused on driving growth for your business.